H.R.4173 – Dodd-Frank Wall Street Reform and Consumer Protection Act

A project of the Participatory Politics Foundation and the Sunlight Foundation

A non-profit, non-partisan public resource

Everyone can be an insider. Learn how.

- Bills

- Senators

- Representatives

- Votes

- Issues

- Committees

- The Money Trail

- Blog

- Groups

- Start a New Group

- Resources

- Wiki

- Vote Comparison

- Site Widgets

- States

- How-to Use OpenCongress

- Follow Our Twitter

- All Resources

To provide for financial regulatory reform, to protect consumers and investors, to enhance Federal understanding of insurance issues, to regulate the over-the-counter derivatives markets, and for other purposes.

Get Non-Congressional Legal Forms and PDF Templates

At OpenCongress and FormsPal, we are committed to providing free and accessible information so communities and individuals can be better informed.

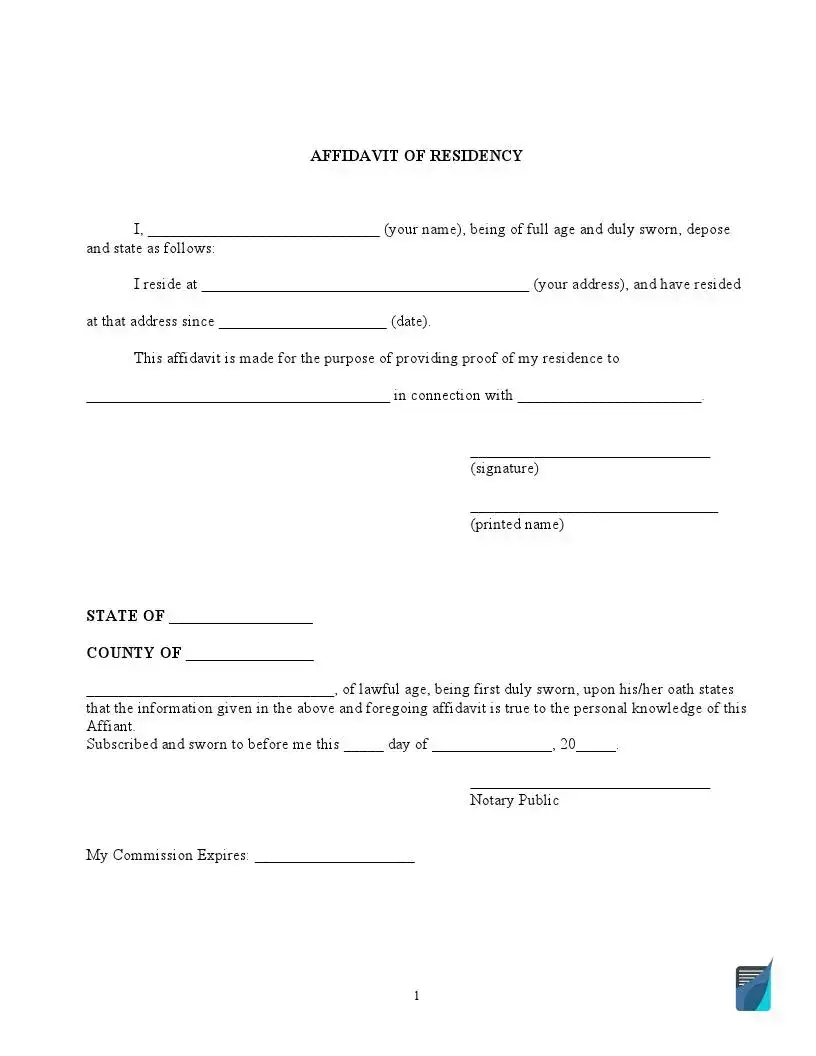

Find Fillable Affidavit Forms

An affidavit form is intended to verify a written statement under oath. In this document, the individual known as the affiant affirms that all information presented in the affidavit is truthful and accurate. Affidavit forms are legally binding and should be approached with seriousness. They must be produced voluntarily and signed before witnesses and a notary public. Using the correct affidavit template is essential to ensure the document is valid and of high quality. We provide the appropriate templates to meet your needs.

The Most Widely Used Affidavit Forms

An affidavit form is utilized whenever an individual needs to substantiate the authenticity of certain facts. This form can be used to verify your own or someone else’s identity, report a person’s death, certify a name change, or confirm your place of residence.

It’s common for individuals to marry U.S. citizens to gain permanent residence in the United States. As a result, the U.S. Citizenship and Immigration Services (USCIS) imposes certain conditions on such residency. After two years of marriage, these conditions can be lifted by submitting Form I-751 (Petition to Remove Conditions on Residence). To demonstrate the authenticity of the marriage and potentially bypass extensive interviews, couples are advised to include an Affidavit of Friends, also known as a Letter of Support for I-751, with their application. This affidavit should be written by individuals who know the couple well and can attest to the legitimacy of their marriage.

An Affidavit of Heirship Form is beneficial when you need to establish yourself as the heir of someone who has passed away without a will. This type of affidavit is a cost-effective and time-saving method to expedite the probate process, allowing for the swift distribution of the decedent’s property and assets to beneficiaries.

A Residency Affidavit is used to verify that you reside at a specific address. This type of affidavit typically pertains to a long-term dwelling, such as an apartment or house, whether owned or rented. Often, the Department of Motor Vehicles (DMV) requires an affidavit of residence when applying for a driver’s license.

An Affidavit of Service Template allows you to produce a legal document that certifies a person has received specific legal documents from you. This form is commonly utilized in court proceedings and legal disputes. It should include a detailed description of the documents, the date and method of delivery, the location where they were delivered, and the identity of the person responsible for the delivery.

Sample Affidavit of Residency:

Affidavit Types

An affidavit serves multiple purposes, but regardless of its use, certain elements should always be included: details about the affiant, written statements that the affiant declares to be true, acknowledgments from witnesses and a notary, and any relevant attachments that support the statements.

- Affidavit of Correction Title

- Affidavit of Death Form

- Domicile Affidavit

- Affidavit of Identity Form

- Gift Affidavit Form

- Financial Affidavit Form

- Scrivener’s Affidavit

- Affidavit of Indigency

- Birth Affidavit

- Single Status Affidavit

- Affidavit of Affixture

Find Fillable Loan Agreement Forms

A loan agreement is established to safeguard the lender’s interests in the money loaned. For added security, a lender may opt for a secured loan agreement involving collateral. Collateral is typically a high-value asset the borrower owns, such as a car or house, that the lender can claim if the borrower defaults on the loan. This provision often motivates the borrower to make timely repayments. However, even an unsecured loan agreement is legally enforceable. The lender can initiate legal proceedings if the borrower fails to make payments. Creating a loan agreement is crucial for both borrowing and lending parties, as it provides protection and helps preserve positive relations, particularly in transactions involving family members or employees.

Loan Agreement Types

A Payment Plan Template can be used if you cannot repay the loan in one go. This document facilitates an arrangement with your lender to repay the loan according to a mutually agreed schedule. This schedule could be set for quarterly, monthly, or weekly payments, depending on what works best for both parties. The plan must also detail the agreed-upon payment method. Payment plans cover expenses like tuition, dental treatments, or overdue rent. The agreement should clearly outline the information of the lender and the borrower, the total debt, any initial down payment, and the full repayment schedule.

A Car Sale Contract with Payments, also known as a Vehicle Repayment Agreement, can be utilized for private vehicle sales where the buyer wishes to pay in installments. This type of loan agreement includes standard details such as the parties’ contact information, the loan amount, the interest rate, and the repayment schedule. It must contain a detailed vehicle description, including its make, model, year of manufacture, color, and Vehicle Identification Number (VIN). This agreement particularly benefits individuals or families who need a car but cannot pay the full amount upfront.

Many people mistakenly believe formal agreements aren’t necessary when borrowing money from family or friends. Yet, this is precisely when such agreements are most crucial. Financial disputes are a common cause of strained relationships among relatives and friends. A Family Loan Agreement can prevent these conflicts by clarifying the loan terms and ensuring repayment. This document is particularly useful in situations where financial institutions may deny credit, allowing family members to support each other. While borrowing from a family might offer more lenient terms and lower interest rates, it’s important to remember that repayment is still expected. A formal agreement helps maintain respect and unity by setting clear expectations.

An IOU Template is a concise and direct legal document that records a financial obligation where one party borrows money from another and commits to repayment. This document typically includes the names of both the lender and the debtor, the amount of the loan, the due date, and, occasionally, a repayment schedule. Generally, an IOU is employed for smaller sums of money and between individuals who share a trustful relationship, such as friends or relatives. Despite its simplicity, an IOU is legally binding and can be evidence in legal proceedings if necessary.

If you require a guarantor for a loan, a Personal Guarantee Template can be used. This document ensures that the guarantor is legally accountable for repaying the loan under the same terms as the borrower, should the borrower fail to meet their obligations. The personal guarantee includes details about all parties involved, such as the lender, borrower, and guarantor. By including a personal guarantor, the lender gains additional security, which may lead to more favorable terms for the borrower, such as lower interest rates or other benefits.

If you need to cover tuition or medical expenses but lack the funds, borrowing from your employer might be a viable option. An Employment Loan Agreement is essential to clarify and formalize the terms of such a loan. This document outlines all crucial aspects of the agreement to protect both parties involved. It includes contact information for all parties, the loan amount, details on how repayments will be deducted from the employee’s paycheck, conditions applicable in the event of a default or if the employee leaves the company, and signatures from all parties. This agreement ensures that the employer and employee understand their commitments and responsibilities clearly.

Fillable PDF Forms

You can select from our extensive collection of PDF forms, organized into categories for your convenience. These documents are customizable and can be prepared quickly. Simply choose the appropriate category, complete the form, and your PDF document will be ready to use anywhere, on any device, and without Internet access.

Financial

ADP Pay Stub Template

Advance Beneficiary Notice of Non-coverage

AIA G702 G703

Apartment Lease Agreement

Auto Repair Estimate Form

Bill of Lading Form

Blank Invoice Template

Cash Drawer Count Sheet

Cash Receipt

Citibank Direct Deposit Form

Credit Report Dispute Form

Goodwill Donation Receipt

Independent Contractor Pay Stub Template

Order Form

Payroll Check Template

Profit and Loss Template

Purchase Order Form

Purchase Request Form

Roofing Estimate Template

Straight Bill of Lading Form

US Courts Form 271

US DoL WH-347

Local

CDSS Form SAR-7

Cornerstone Christian Correspondence School Transcript

DWC 250 Notice of Election to Be Exempt

EDD Form DE 2501

Form DL-43

Kern County Sheriff Restraining Order Form

LADBS NEC Standard Electrical Load Calculation

Mechanics Lien California

NYC Disability Parking Permit

SJCERA Special Power of Attorney

Texas Law Help FM-DivC-100 Original Petition for Divorce Set C

Texas Nurse Aide Registry Form 5505-NAR

Texas Temporary Tag

TMRS Direct Deposit Authorization

TREC One to four family residential contract

TSBPE Plumbing Inspector Examination

Employment

Bio Data Template

Blank Resume Template

Employee Availability Form

Employment Verification Form

Fillable Pay Stub

Letter of Resignation

OPM Optional Form 306

OPM SF-15 Form

OPM SF-182 Form

Statement of Intent to Employ Minor

Time Card Template

Charts and Tables

52 Week Money Challenge

64 Team Double Elimination Bracket

96 Well Template

Check Register Template

DnD Character Sheet

Eco Map

Electrical Panel Schedule Template

Estimate Template

High School Transcript Template

Medevac Request Form GTA 08-01-004

Myers Briggs Compatibility Chart

NCAA Bracket

Packing List Template

Pedigree Chart

Prescription Pad Template

Yahtzee Score Card

All Bill Titles

Official: To provide for financial regulatory reform, to protect consumers and investors, to enhance Federal understanding of insurance issues, to regulate the over-the-counter derivatives markets, and for other purposes. as introduced.

Short: Accountability and Transparency in Rating Agencies Act of 2009 as introduced.

Short: Consumer Financial Protection Agency Act of 2009 as introduced.

Short: Corporate and Financial Institution Compensation Fairness Act of 2009 as introduced.

Short: Credit Risk Retention Act of 2009 as introduced.

Short: Dissolution Authority for Large, Interconnected Financial Companies Act of 2009 as introduced.

Short: Federal Insurance Office Act of 2009 as introduced.

Short: Financial Stability Improvement Act of 2009 as introduced.

Short: Investor Protection Act of 2009 as introduced.

Short: Over-the-Counter Derivatives Markets Act of 2009 as introduced.

Short: Private Fund Investment Advisers Registration Act of 2009 as introduced.

Short: Wall Street Reform and Consumer Protection Act of 2009 as introduced.

Short: Derivative Markets Transparency and Accountability Act of 2009 as passed house.

Short: Mortgage Reform and Anti-Predatory Lending Act as passed house.

Short: Nonadmitted and Reinsurance Reform Act of 2009 as passed house.

Official: A bill to promote the financial stability of the United States by improving accountability and transparency in the financial system, to end “too big to fail”, to protect the American taxpayer by ending bailouts, to protect consumers from abusive financial services practices, and for other purposes. as amended by senate.

Short: Wall Street Reform and Consumer Protection Act of 2009 as passed house.

Short: Accountability and Transparency in Rating Agencies Act of 2009 as passed house.

Short: Consumer Financial Protection Agency Act of 2009 as passed house.

Short: Corporate and Financial Institution Compensation Fairness Act of 2009 as passed house.

Short: Credit Risk Retention Act of 2009 as passed house.

Short: Dissolution Authority for Large, Interconnected Financial Companies Act of 2009 as passed house.

Short: Expand and Preserve Home Ownership Through Counseling Act as passed house.

Short: Federal Insurance Office Act of 2009 as passed house.

Short: Financial Stability Improvement Act of 2009 as passed house.

Short: Investor Protection Act of 2009 as passed house.

Short: Private Fund Investment Advisers Registration Act of 2009 as passed house.

Short: Restoring American Financial Stability Act of 2010 as passed senate.

Short: Bank and Savings Association Holding Company and Depository Institution Regulatory Improvements Act of 2010 as passed senate.

Short: Consumer Financial Protection Act of 2010 as passed senate.

Short: Enhancing Financial Institution Safety and Soundness Act of 2010 as passed senate.

Short: Financial Stability Act of 2010 as passed senate.

Short: Improving Access to Mainstream Financial Institutions Act of 2010 as passed senate.

Short: Nonadmitted and Reinsurance Reform Act of 2010 as passed senate.

Short: Office of National Insurance Act of 2010 as passed senate.

Short: Pay It Back Act as passed senate.

Short: Payment, Clearing, and Settlement Supervision Act of 2010 as passed senate.

Short: Private Fund Investment Advisers Registration Act of 2010 as passed senate.

Short: Wall Street Transparency and Accountability Act of 2010 as passed senate.

Popular: Dodd-Frank Wall Street Reform and Consumer Protection Act as introduced.

Short: Dodd-Frank Wall Street Reform and Consumer Protection Act as enacted.

Short: Bank and Savings Association Holding Company and Depository Institution Regulatory Improvements Act of 2010 as enacted.

Short: Consumer Financial Protection Act of 2010 as enacted.

Short: Enhancing Financial Institution Safety and Soundness Act of 2010 as enacted.

Short: Expand and Preserve Home Ownership Through Counseling Act as enacted.

Short: Federal Insurance Office Act of 2010 as enacted.

Short: Financial Stability Act of 2010 as enacted.

Short: Improving Access to Mainstream Financial Institutions Act of 2010 as enacted.

Short: Investor Protection and Securities Reform Act of 2010 as enacted.

Short: Mortgage Reform and Anti-Predatory Lending Act as enacted.

Short: Nonadmitted and Reinsurance Reform Act of 2010 as enacted.

Short: Pay It Back Act as enacted.

Short: Payment, Clearing, and Settlement Supervision Act of 2010 as enacted.

Short: Private Fund Investment Advisers Registration Act of 2010 as enacted.

Short: Wall Street Transparency and Accountability Act of 2010 as enacted.

- Overview

- Actions & Votes

- Money Trail

- News (591) & Blogs (2K)

- Comments (83)

Bill’s Views

Today: 147

Past Seven Days: 721

All-Time: 414,893

Official Bill Text

Comment on about 2,253 Pages

| Introduced | House Passed | Senate Passed | President Signed |

| 12/01/09 | 12/11/09 | 05/19/10 | 07/20/10 |

Sponsor

Barney Frank

D-

No Co-Sponsors

Committees

House Financial Services

House Agriculture

House Energy and Commerce

House Judiciary

House Rules

House Budget

House Oversight and Government Reform

House Ways and Means

Senate Banking, Housing, and Urban Affairs

Hide Committees

Related Issue Areas

Finance and financial sector

Accounting and auditing

Administrative law and regulatory procedures

Administrative remedies

Advisory bodies

Aging

Bank accounts, deposits, capital

Banking and financial institutions regulation

Bankruptcy

Business records

Civil actions and liability

Commodities markets

Commodity Futures Trading Commission

Congressional oversight

Consumer affairs

Consumer credit

Credit and credit markets

Department of the Treasury

Employment discrimination and employee rights

Evidence and witnesses

Executive agency funding and structure

Federal Deposit Insurance Corporation (FDIC)

Federal Reserve System

Federal Trade Commission (FTC)

Federal preemption

Financial crises and stabilization

Financial services and investments

Fraud offenses and financial crimes

Government information and archives

Government investigations

Government trust funds

Housing finance and home ownership

Insurance industry and regulation

Judicial review and appeals

Licensing and registrations

Marketing and advertising

Minority and disadvantaged businesses

National Credit Union Administration

Securities

Securities and Exchange Commission (SEC)

Small business

Women in business

Women’s employment

Department of Housing and Urban Development

Foreign and international banking

Real estate business

Data via Congressional Research Service

Hide Issues

Latest Vote

Result: Conference Report Agreed to – July 15, 2010

Roll call number 208 in the Senate

Question: On the Conference Report (Conference Report to Accompany H.R. 4173)

Required percentage of ‘Aye’ votes: 1/2 (50%)

Percentage of ‘aye’ votes: 60%

OpenCongress Summary

This is comprehensive legislation to overhaul regulations in the financial sector. It would establish a new Consumer Financial Protection Agency to regulate products like home mortgages, car loans and credit cards, give the Treasury Department new authority to place non-bank financial firms, like insurance companies into receivership, regulate the over-the-counter derivatives market, and more.

OpenCongress bill summaries are written by OpenCongress editors and are entirely independent of Congress and the federal government. For the summary provided by Congress itself, via the Congressional Research Service, see the “Official Summary” below.

Official Summary

12/11/2009–Passed House amended. Wall Street Reform and Consumer Protection Act of 2009 – Title I: Financial Stability Improvement Act – Financial Stability Improvement Act of 2009 – (Sec. 1000A) Directs the Comptroller General to audit and report to Congress within two years after enactm…Read the Rest

Organizations Supporting H.R.4173

American Association of Retired Persons

Public Citizen

Petroleum Marketers Association of America

National Farmers Union

Western Peanut Growers Association

Appraisal Institute

…and 6 more. See all.

Organizations Opposing H.R.4173

National Association of Federal Credit Unions

American Bankers Association

Independent Community Bankers of America

US Chamber of Commerce

National Association of Mortgage Bankers

Business Roundtable

…and 1 more. See all.

See the money trail behind this bill for more info on how campaign contributions may be influencing senators’ and representatives’ votes.

Latest Letters to Congress

H.R.4173 Dodd-Frank Wall Street Reform and Consumer Protection Act

jezzaman2010 June 14, 2013

I oppose H.R.4173 – Dodd-Frank Wall Street Reform and Consumer Protection Act, and am tracking it using OpenCongress.org, the free public resource website for government transparency and accountability.

This bill needs to be repealed! It establishes a Cyrus style bail-in mechanism that would enable the government to transfer enormous amounts of wealth from the collapsing banks into the hands of a private cartel that control the new Orderly Liquidation Authority.

It imposes amendments to pre…

H.R.4173 Dodd-Frank Wall Street Reform and Consumer Protection Act

goirish August 08, 2012

I am writing as your constituent in the 14th Congressional district of Ohio. I oppose H.R.4173 – Dodd-Frank Wall Street Reform and Consumer Protection Act, and am tracking it using OpenCongress.org, the free public resource website for government transparency and accountability.

Sincerely,

Dan Mulcahy

See All Letters (4)

Related Bills

H.R.3126 Consumer Financial Protection Agency Act of 2009

Introduced Dec 09, 2009

254 views

H.R.3818 Private Fund Investment Advisers Registration Act of 2009

Introduced Dec 17, 2010

8 views

H.Res.956 Providing for consideration of the bill (H.R. 4173) to provide…

House Passed Dec 09, 2009

3 views

H.Res.964 Providing for further consideration of the bill (H.R. 4173) to…

House Passed Dec 10, 2009

2 views

S.3217 Restoring American Financial Stability Act of 2010

Introduced May 25, 2010

376 views

H.Res.1490 Providing for consideration of the conference report to accom…

House Passed Jun 30, 2010

5 views

Vote on This Bill

36% Users Support Bill

399 in favor / 695 opposed

Yes No

Send Your Rep a Letter

about this bill

Support

Oppose

Tracking

Track with MyOC

Subscribe To This Bill

Get Email Alerts

Share This Bill

Share via Email

Save to Notebook

Make A Bill Widget

Send us Feedback

Top-Rated Comments

“i don’t understand how those companies were allowed to become “too big t…”

nogoodonesleft

“repealing glass steagall act in the clinton days was the problem. what a…”

toray99

OC Blog Articles Related To This Bill

Senators Say DOJ is Lying About the PATRIOT Act

Sep 22, 2011

Good luck with that pivot

Aug 05, 2011

After Weeks of Delay, Senate Small Biz Jobs Bill in Jeopardy

Apr 20, 2011

Loophole Alert — Lincoln’s Derivatives Language Perhaps Not All it’s Cracked Up to Be

May 16, 2010

Recent OC Blog Articles

Sign Up to Help Test an Improved OpenCongress

Sep 04, 2013

Follow #OpenGov Leaders on Micropublishing

Jun 17, 2013

Three #OpenGov Events This Week

Jun 03, 2013

OC at Transparency Camp 2013

May 01, 2013

OpenGovernment.org at National Conference on Media Reform

Apr 04, 2013

OpenCongress

- Search

- About OpenCongress

- Help FAQ

- RSS Feeds

- Widgets

- Developers/API

- Our Staff

- Contact Us

Go to

- Bills

- Senators

- Representatives

- Votes

- Issues

- The Money Trail

Go to

- Wiki

- Blog

- Video

- Resources

My OpenCongress

- Login

OpenCongress is a free and open-source project of the Participatory Politics Foundation, a 501(c)3 non-profit organization with a mission to increase civic engagement. The non-profit Sunlight Foundation is the Founding and Primary Supporter of OpenCongress.